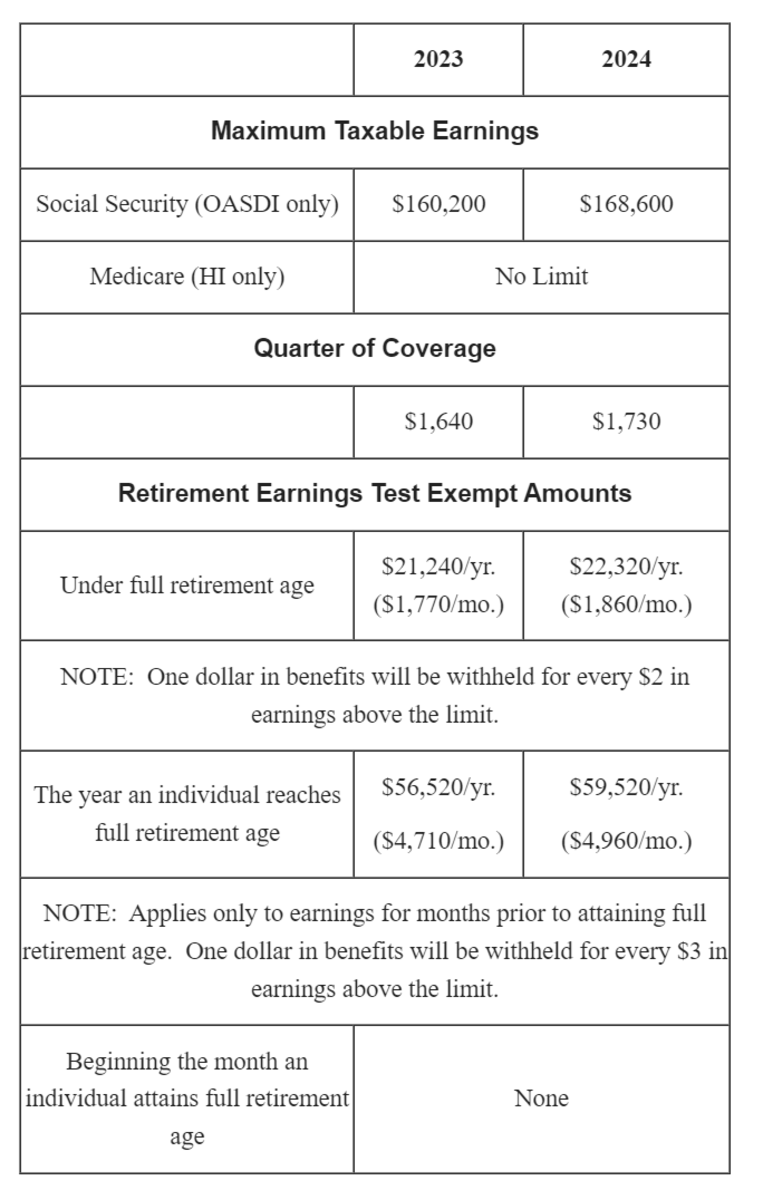

Max Social Security Tax 2025. What’s the maximum you’ll pay per employee in social security tax next year? One of these is the maximum amount of earnings.

This blog explores the new taxable maximum,. Retirees do not have to pay taxes on benefits until their provisional income equals $25,000 for single tax filers or $32,000 for married filers.

2025 Max Social Security Tax By Year 2025 Diana Wallace, 11 rows if you are working, there is a limit on the amount of your earnings that is taxable by social security.

Social Security Max 2025 2025 Jenni Fermay, Individual taxable earnings of up to $176,100 annually will be subject to social security tax in 2025, the social security administration (ssa) said thursday.

2025 Max Social Security Tax By Year 2025 Stephen Mathis, Once workers reach that max, they don’t pay.

Max Social Security Payment Tax 2025 Olivia Rees, To know if you exceed the limit, check your overall earnings.

Maximum Social Security Tax Withholding 2025 Calendar Fiona Pullman, Once workers reach that max, they don’t pay.

2025 Max Social Security Tax By Year 2025 Diana Wallace, One of these is the maximum amount of earnings.

Social Security Tax Limit 2025 Calendar Anthony Gibson, The 2025 limit is $176,100, up from $168,600 in 2025.

Max Social Security Payment Tax 2025 Married Filing Phil Hughes, Retirees do not have to pay taxes on benefits until their provisional income equals $25,000 for single tax filers or $32,000 for married filers.

Social Security Max Allowed 2025 Clem Carmina, This amount is known as the “maximum taxable earnings” and changes each.

Social Security Tax Maximum 2025 Ella Walker, The 2025 limit is $176,100, up from $168,600 in 2025.

DIY Tutorials WordPress Theme By WP Elemento